Mapping Work, Not Markets

A Process-First Investment Thesis for Enterprise AI

The next $10 billion enterprise AI company won’t be built by someone who thinks in “use cases.” It’ll be built by someone who can trace exactly how a purchase requisition becomes a payment across procurement, sourcing, invoicing, and treasury, through five systems and four approvals, each with its own data model.

While most investors chase markets, I map work.

Why Process First

Agentic AI is changing the nature of enterprise software. The question is no longer “Where can I use AI in this department?” It’s “What would this department look like if agents ran 60% of it?”. And you can’t answer that question without understanding the work itself.

I started my career at SAP building something most people have never heard of: a business process ontology. I mapped how work actually happens across 25 industries and 11 lines of business. This ontology, a formal map of business processes and their relationships, became the foundation for semantic layers that translate between how businesses describe work and how systems execute it. Not how consultants think it happens. Not how software vendors wish it happened. How it actually happens, every approval, every handoff, every place where data gets stuck. That experience taught me something crucial: enterprises don’t buy AI. They buy solutions to workflow problems.

That’s why I evaluate startups based on their understanding of how information flows inside companies, not just what their model can do.

From People to Processes and Back

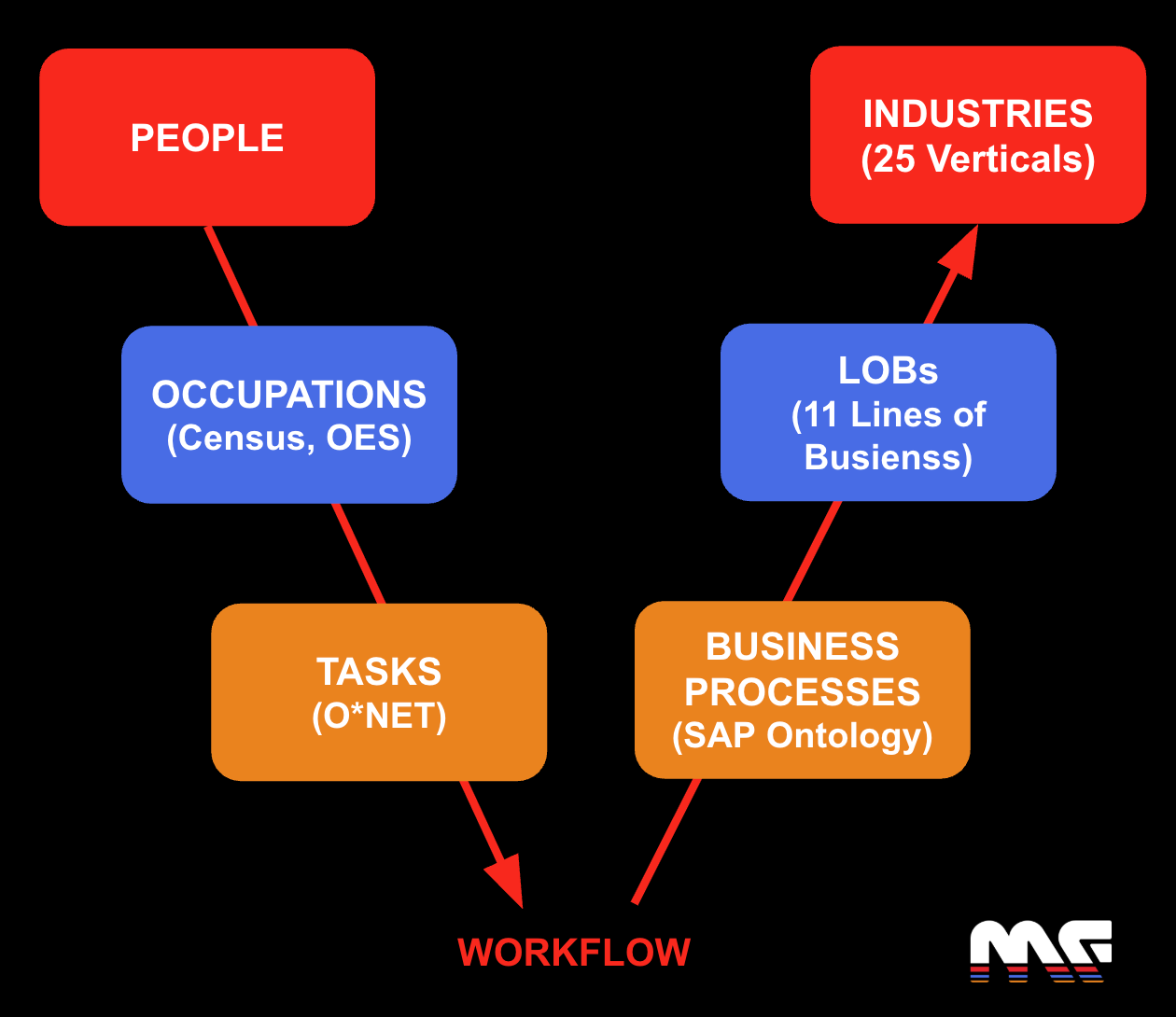

Instead of starting with use cases or verticals, I decompose work systematically:

This lets me reason top-down (Who does what work?) and bottom-up (How do those tasks recombine into core processes?). The goal is to identify where agentic automation can create real value across the enterprise, regardless of vertical.

Each layer answers critical questions:

People/Occupations: Who performs the work? What are their roles, skills, and decision boundaries?

Tasks: What do they actually do every day? How much can be automated today vs. near-term?

Business Processes: How are those tasks orchestrated into workflows that deliver outcomes?

Lines of Business: Which functional domain owns the process?

Industries: How much variation exists across sectors?

The Vertical Trap

I’m seeing 10+ startups just in sales order processing, each claiming their vertical requires specialized AI. “Healthcare orders are different!” “Manufacturing has unique requirements!”

Usually, they’re wrong.

When I decompose their “unique” workflows, I find the same pattern. But here’s what these founders are actually sensing: every industry has evolved its own semantic layer. A “customer” in healthcare is a “patient.” In banking, they’re an “account holder.” In manufacturing, they’re a “buyer.” The entity is functionally identical (someone who owes you money for services), but every industry wraps it in different vocabulary.

True vertical differentiation only exists when the process architecture itself is unique (clinical trials in pharma, loan origination in banking), when regulation fundamentally reshapes the workflow, or when domain expertise is required to interpret the data, not just relabel it.

Most vertical AI startups aren’t building vertical solutions, they’re building horizontal workflows with vertical vocabulary. The ones who recognize this and architect for semantic configurability rather than vertical specialization will capture 10x more value.

How I Evaluate: The Three Filters

I’m looking for founders who understand the work deeply enough to automate it reliably at scale.

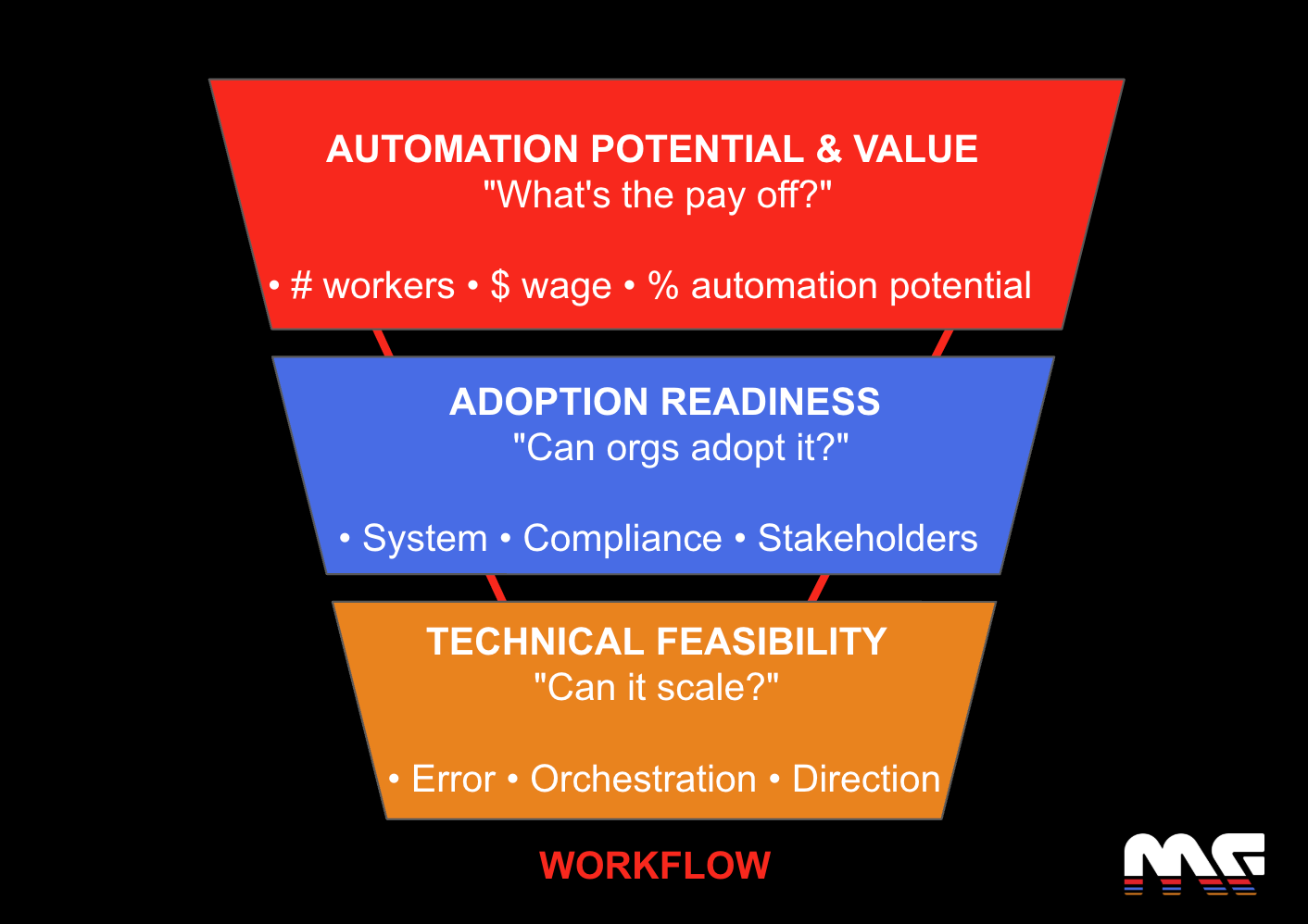

1. Automation Potential & Value

Automation potential = What percentage of a process can be realistically automated with current AI?

Automation value = Number of workers × average wage × automation potential

For example, founders who know their process can tell me exactly: “In accounts payable, we know X% is rule-based matching (fully automatable), Y% requires exception handling (partially automatable), Z% needs human judgment for vendor disputes (human-required).”

If they can’t break it down this precisely, they don’t know the work.

2. Adoption Readiness

Technical feasibility ≠ organizational readiness. Even when automatable, adoption depends on:

System integration (How digital/connected is the workflow?)

Compliance requirements (How much human oversight is legally or culturally required?)

Stakeholder complexity (How many people must align to change the process?)

Data structure (Can AI actually reason over the inputs?)

High adoption = standardized, repeatable, already digital. Low = fragmented, people-heavy, organizationally resistant.

3. Technical Feasibility

This reveals if founders have actually built enterprise software. The questions that matter:

How do you handle errors in a multi-system workflow? (robustness, evaluation, fallback logic)

How do you coordinate multiple agents effectively? (task delegation, communication protocols)

How do you integrate agents with human workflows? (handoffs, explainability, trust)

How do you manage agent resources and capabilities? (cost, latency, prioritization, governance)

How do you expand from this current process to an adjacent one? (roles overlap, context engineering, structure vs semantics)

Founders who hand-wave these questions are building demos, not products.

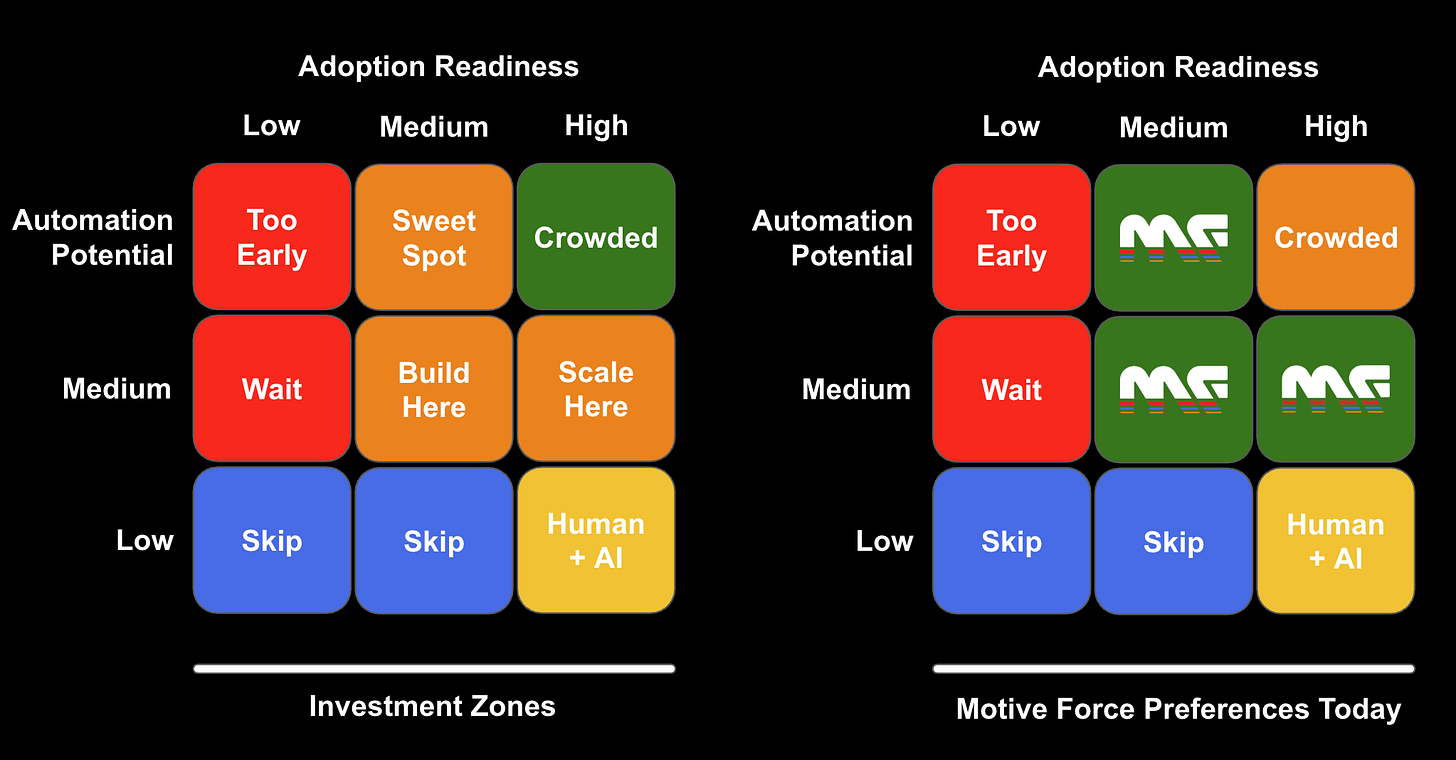

Where I Invest

Founders who understand process sequence (where one workflow hands off to the next), roles touched and degree of automation x adoption readiness, can choose the right entry point.

Green Zone (High automation, high adoption): Quick wins where AI already works. Structured data, repeatable workflows, measurable ROI. Great for case studies but crowded with competition.

Orange Zones (Medium-high automation, medium-high adoption): Where billion-dollar companies get built. Complex enough that incumbents struggle, feasible enough that focused startups can win. These require cross-system orchestration (SRM ↔ ERP ↔ CRM) and produce massive value once solved.

Red Zones (Low adoption or low automation): Either too early (waiting for AI breakthroughs) or not worth automating.

Yellow Zone (Low automation, high adoption): Human-in-the-loop opportunities. Augmented decision support rather than full automation.

I invest where technical feasibility meets organizational readiness, but hasn’t been commoditized yet. To show how this works in practice, I will be picking one line of business and map every workflow to identify the opportunities. I will share that analysis in a future post.

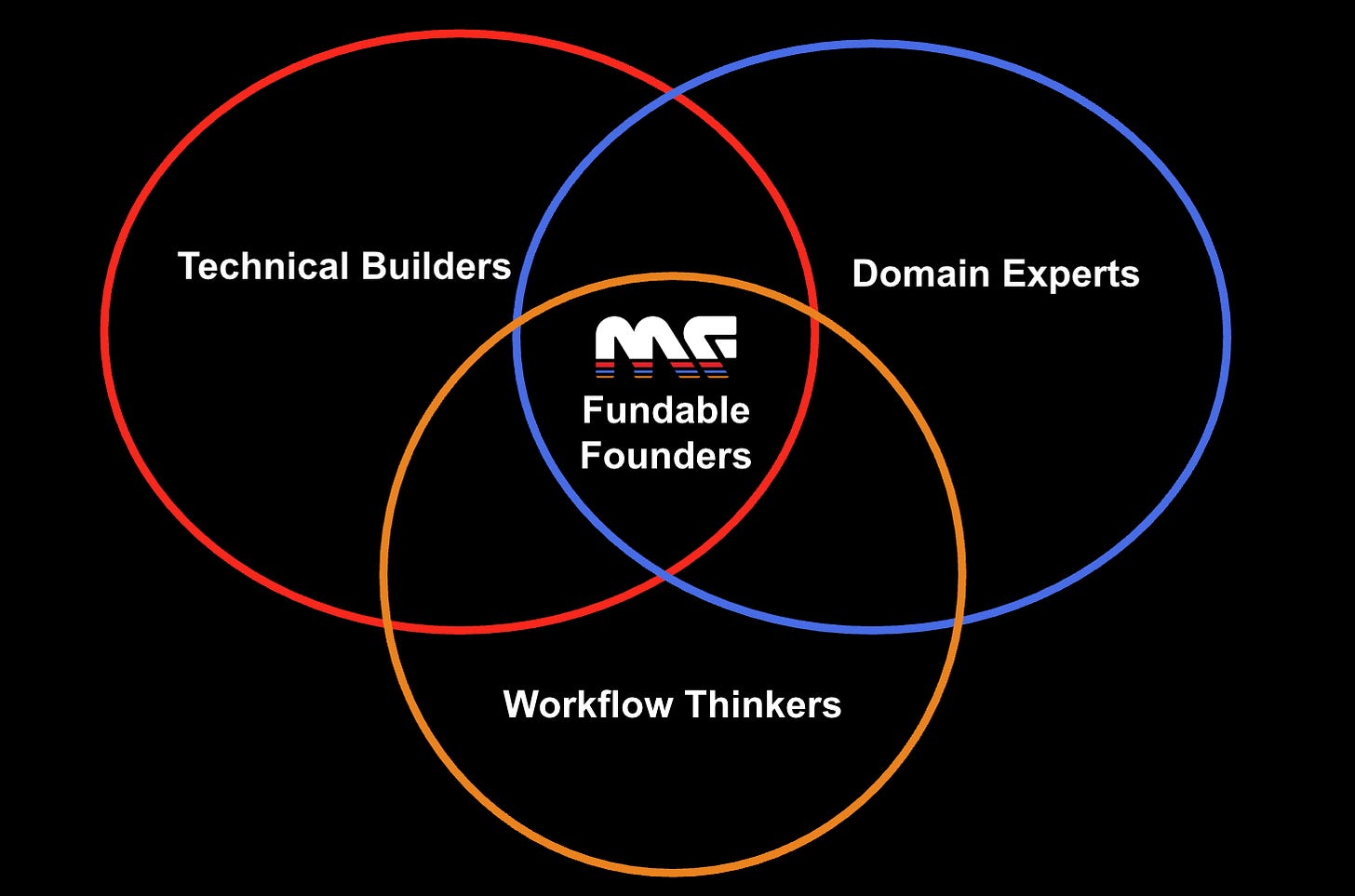

The Founders I’m Looking For

Beyond understanding workflows, I’m seeking:

Technical builders who’ve lived inside the legacy stack (SAP, Oracle, Workday…)

Domain experts who’ve felt the pain firsthand

Workflow thinkers who trace processes like electrical engineers trace circuits.

These founders combine three rare qualities:

Deep process knowledge: they know their domain’s workflows cold

Technical sophistication: they need to understand what makes AI reliable at scale, how agentic will directionally evolve

Commercial empathy: they grasp why enterprises buy transformation, not technology

Ready to Build?

I don’t care which industry or line of business you’re in, whether you’re at the imagination stage or have paying customers. I care how well you understand the work. If you can trace a process with precision and reimagine it with agents, I want to meet you.

Don’t pitch me a market. Show me the work.

Reach me at oana@motiveforce.ai

More essays: What Makes 5% of AI Agents Actually Work in Production?, Agentic systems: panning for gold, Semantic layers, Fine Tuning, Founder Mental Software, Normalizing the Founder Journey, AI Engineer World’s Fair 2025 - Field Notes

Wow, this is such a clear way to put it! Understanding the actual data flow is everythign.